The developments in the internet infrastructure and the widespread use of mobile phones and tablets have significantly increased the delivery of financial services through digital channels. Especially in the post-Covit-19 period, the scope of “digital banking” has expanded significantly.

A serious step taken for the spread of “digital banking” in Turkey, providing convenience and 7 day / 24-hour access for financial services is new regulation of BRSA “Service Principles of Digital Banks”, which came into effect as of January 1st, 2022. This regulation ensures that “banks w/o branches, serving through only electronic banking services distribution channels” can serve financial consumers and SMEs as “digital banks”.

According to the relevant regulation, main requirements for being a “digital bank” can be summarized as follows:

- Digital banks are defined as “credit institutions that provide banking services through electronic banking services distribution channels instead of physical branches”- that is, deposit and participation banks that provide banking services as specified in the definition - development and investment banks are excluded.

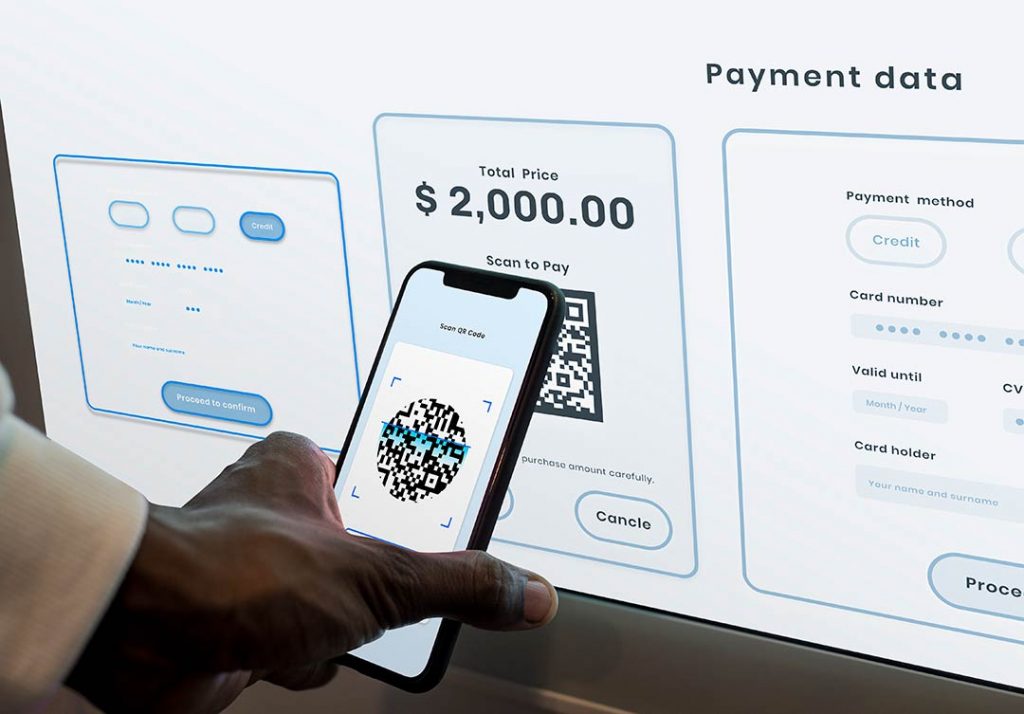

- Banking services will be carried out “without a branch”, and services will be provided in all kinds of electronic distribution channels where consumers can receive service (internet banking, mobile banking, telephone banking, open banking, ATM, etc.)

- The minimum paid-in capital requirement is 1 Billion TL - BRSA may increase this amount if necessary.

- They can offer all the services that credit institutions can offer, depending on whether they are a deposit or participation bank (for example, they can provide cash withdrawal services to their customers or load balances to prepaid payment instruments through merchants that have made an agreement with them to accept bank, credit and prepaid cards.

- In terms of the legislation to be complied with, all the provisions of the legislation that the credit institutions are obliged to comply with must also be complied with.

- There are some restrictions in terms of activities. According to this;

- Credit customers of digital banks can only be financial consumers or SMEs.

- It is forbidden for digital banks to organize under any name such as correspondent, agency, representative office, open physical branches, provide safe deposit boxes and custodial transactions and custody services, except for those that will be carried out in the digital environment. However, unless used as a branch office, at least one physical office must be established to handle customer complaints.

- The total of unsecured cash consumer loans that digital banks can make available to a customer - excluding credit card expenditures and cash withdrawals and overdraft accounts - is four times the monthly average net income of the relevant customer declared and confirmed by digital banks, and the average monthly net income of the customer. If the income cannot be determined, it will not exceed ten thousand Turkish Liras.

- Service continuity commitment is so crucial that committed continuity percentage for internet banking and mobile banking distribution channels cannot be lower than 99.8% for digital banks.

- The regulation also states that companies providing technology, electronic commerce and telecommunication services can also establish digital banks. In this case:

- The dominant partner legal entities or the real and legal persons controlling these legal entities are resident in Turkey, and

- Signing an information exchange agreement with the Risk Centre in order to share the risk data they hold regarding the indebtedness and financial power of residents in Turkey.

The first company in Turkey to obtain a 'digital bank' license became Hayat Katılım Bankası (April 22nd), with minimum of 1 billion 500 million founding capital. The founding partners are Hayat Holding AŞ, Hayat Kimya Sanayi AŞ, AS Tüketim Malları Ticaret AŞ, Kastamonu Entegre Ağaç Sanayi ve Ticaret AŞ and Limaş Port Management AŞ.

Another company that received the license is Kasa Katılım Bankası AŞ (July 8th), with founding partners Great East Capital Bilgi Teknolojileri Yatırımları AŞ, Adam Muhammed Sadıq, Maryam Khalid Al-Atteyah, Hector Fernando Sepul Veda Reyes Retena and Yağmur Şatana.

On a global scale, there are very successful “digital bank” brands out of finance sector. Especially companies from innovative sectors such as technology, telecommunication and e-commerce have established very creative examples.

One of these examples is the application launched in Singapore in 2012 as MyTeksi, an online taxi locator application similar to Uber, and took the name Grab in 2016 which is now an Indonesia-based payment company. After the company bought Indonesia-based payment system Ovo, established Grab Pay and obtained the digital bank license, it has turned into a super application providing various services such as food and grocery delivery, financial services and hotel reservation.

Another example in Singapore is Ant Financial, owned by AliPay, one of the major SuperApps. AliPay is one of the first examples of super applications in the world and has a very important position in Asia. Ant Financial's acquisition of a digital wholesale bank (DWB) license signals that it will be a very serious competitor for SMEs.

According to the European Ecosystem Report prepared by World Bank consultant Mehmet Kerse, there are three main approaches for regulation of digital banks globally.

The first approach requires obtaining a special digital banking license to enter this sector, called as Bespoke Licensing Regime - as in Turkey. This approach is mostly adopted by Asian countries. Hong Kong, Korea, Philippines, Malaysia, Taiwan and Singapore are the prominent countries.

Two different licenses are offered in Singapore, a “digital full bank” (DFB) aimed more at retail customers, and a “digital wholesale bank” (DWB) aimedat SMEs.

Two important examples in Hong Kong are Airstar, in which Xiaomi has 90% shares, and Mox, whose founding CEO is a Turk (Deniz Güven) and Standard Charter is among its partners.

According to this approach; branching is not allowed, people with lower income and SMEs are prioritized as the main target group, and that a certain minimum capital requirement is sought even though it varies from country to country.

The second approach is Phased Authorization, in which digital banks go through a transition period before becoming a licensed and fully operational bank. Examples of this include England, Australia and Malaysia. This approach does not require a separate license for digital banking.

England is one of the countries that took the first step in digital banking by establishing the New Bank Start-up Unit under the Bank of England (BOE). Prominent digital banks in England are Monzo, Revolut, Atom and Starling. Revolut operates in more than 40 countries.

While the model in Australia envisages a transition period of up to 24 months, in Malaysia transition period is a necessity and should last between three and five years.

The third approach is Licensing Digital Banks as Commercial Banks, which is the most common in the world. In this model, which is more common in countries such as Germany, South Africa, and Brazil, there is also no digital bank license category, and fintech companies with a digital business model are considered in the existing commercial banks category. Fidor and N26, which are examples of Germany, are worldwide digital banks. (N26 operates in more than 20 countries.) Brazil-based Nubank has reached 34 million users in 3 Latin American countries as of 2020.

Conclusion

Especially in the post-Covit period, the banks that we receive service from, like many other sectors, are experiencing a new phase in terms of digitalization.

Offering and expanding banking services in the digital environment provides time and spatial savings for customers. Banks also eliminate branch network and many cost items around it.

The development of technological infrastructures and the increase in transaction volumes in this sector day by day have whetted the appetite of players outside the sector. With the necessary legal regulations, many successful companies with strong technology adaptation around the world can offer much more practical solutions to their customers by adding financial services to their portfolios. Now, 'digital banking' in the world is not only an area where banks offer their services in the 'online' environment, but also a new world in which bright companies that offer many different services and are located outside the banking sector can take part as players.

In Turkey, the first serious step in terms of necessary legal regulations has been taken as of the beginning of 2022 and the details of the 'digital banking' license have been arranged. Although there are not many companies that have joined the sector yet, companies that we have seen serious breakthroughs in the field of ecommerce and that can use technology in an extremely creative way have recently started to offer financial services, making brand new expansions, leading the whole world as in credit card instalments. It would not be surprising witnessing new “SuperApps” from Turkey.

Undoubtedly, the increasing competition provides an environment for traditional banks to diversify and improve the services in digital environment. Recent researches show that customers prefer to use mobile communication channels more, and they are satisfied with completing their transactions in a shorter time with more practical channels such as self-service or chatbot rather than call centre. In this sense, technological developments and effective analysis of consumer needs will continue to contribute significantly to the transformation of the banking sector in terms of the services it offers and the way it is accessed.

Share:

Related Articles

The Road to Success: Market Dynamics ...

In today’s rapidly changing market conditions, the importance of management ...

Leadership in the Digital Age: A New ...

Leadership in the digital age requires embracing continuous learning, innov ...

Mastering Risk Management

Mastering risk management is not merely an option for businesses but a nece ...

International Banking in Germany: A ...

Germany, with its strong industrial structure, high-technology products, an ...

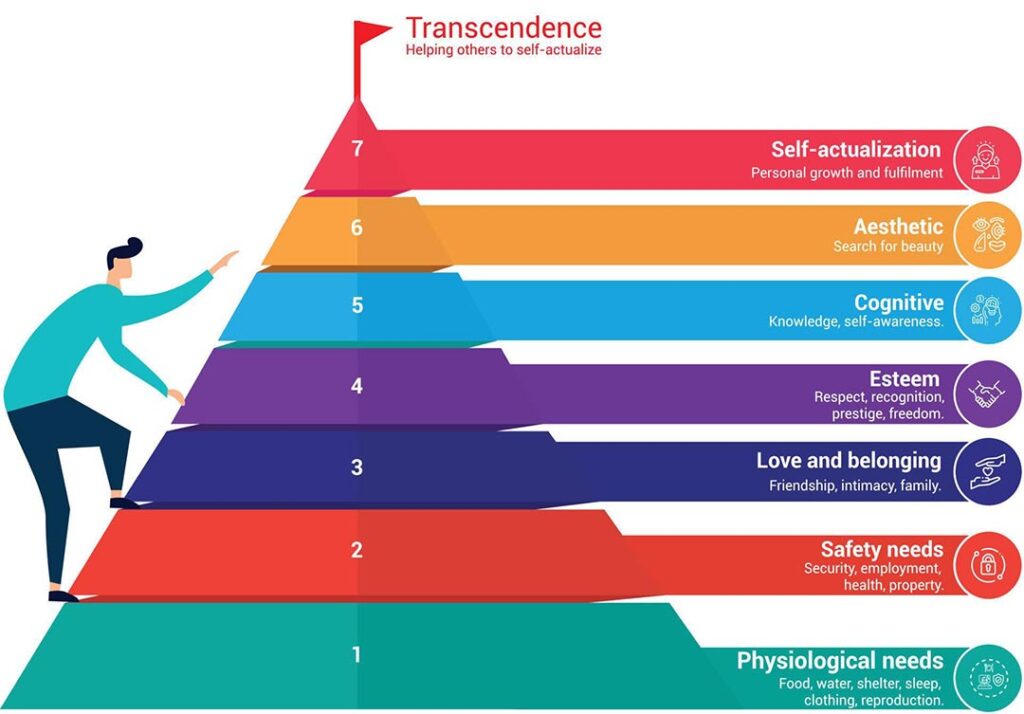

Leadership and Maslow's Hierarchy of ...

Abraham Maslow's hierarchy of needs is a fundamental psychological theory u ...

Leadership and Sustainability of Org ...

Today's business world is characterized by continuous change, technological ...

The Importance of Coaching Skills f ...

The Importance of Coaching Skills for LeadersCoaching skills are essenti ...

Fintech in Turkey: The Rise of Finan ...

Fintech in Turkey: The Rise of Financial Technology

Bancassurance

Bancassurance is a business model that is among the financial services offe ...

Banking and Frankfurt

When the banking and finance sector in Europe is analyzed, it is seen that ...

Digital Banking and Germany

Digital banking is a banking service where customers can do their banking o ...

Banking in Germany

Euro used since 2002 in The Eurozone, the currency of 19 EU members. There ...

Strategic Communication

Strategic communication plays a critical role in the success of an organiza ...

Importance of Supply Chain

The supply chain is a critical factor in which a company manages the flow o ...

Key to Success: Going Digital

Digital transformation is a transformation process that aims to increase th ...

Welfare

Poverty and inequality are one of the biggest challenges the current societ ...

ChatGPT

ChatGPT, developed by the OpenAI company known for its work and research in ...

What is Emotional Intelligence and w ...

Emotional intelligence (also known as emotional quotient or EQ) is the abil ...

The Importance of Women's Employment ...

Women's participation in the workforce is closely related to the level of d ...

Digital Banking II – Digital Banking ...

A serious step taken for the spread of “digital banking” in Turkey, providi ...

The Perception of Morality within Ma ...

If everybody in the world jumped out of a window, would you? This question ...

Digital Banking

Digital banking is a banking technology that offers customers the opportuni ...

Banking, Artificial Intelligence and ...

We have heard the concepts of metaverse, artificial intelligence and machin ...

Green Asset Ratio

Sustainable finance has an important place among the investments made for t ...

Servant Leadership

There is an effective form of management that we often hear about today: se ...

Sustainability In The Global Banking ...

Before Covid-19 wreaked havoc on the world’s economies, the global banking ...

Revolution of Digital Banking

With the European Central Bank considering to investigate for a digital cur ...

Taking Action and Making Decisions i ...

Uncertainty is the fact that an event is not within the framework of certai ...

Wind of Change

Change is an important concept that must be managed for employees at all le ...

Organizational Justice

“What is justice? Giving water to trees. What is injustice? To give water t ...

Open Banking

Digital transformation has started to show its effects in every aspect of o ...

Digital Literacy And Corporate Life

There are many innovations that managers and employees need to follow in or ...

Financial Literacy

The words money and economy are two important concepts that have a great pl ...

Sustainability and Bank

The solutions we have found to our various needs throughout history and ada ...

Adaptability, Flexibility and Leader ...

Being able to adapt to changing conditions is very, very important not only ...

Creativity and Leadership Relationsh ...

The world is getting more competitive every day. For this reason, the servi ...

Competitive Analysis and Banking Sec ...

Competition analysis requires you to examine your direct and indirect compe ...

Delegation in Management

The statements "two heads are better than one" or "teamwork makes the dream ...

Climate Change

All creatures evolve to best adapt to environmental impacts. Those who are ...

Change of Banking Service Channels i ...

Global crises such as the pandemic, force the existing structures to change ...

Innovation

It is undeniable that innovation has a very important place in today's worl ...

Artificial Intelligence

Artificial intelligence is no longer just something specific to science fic ...

Entrepreneurship

Entrepreneurship is the process of starting a new business that incorporate ...

Global Leadership

The world is changing day by day and the information we have today is out o ...

Resilience and Leadership

We encounter many events in life that cause us difficulties and stress. How ...

Entrepreneurial Spirit for Leaders

Why is important for success? The conventional perception of entrepreneursh ...

Finance Leadership in a Pandemic

Crises bring along a period in which institutions need to review their fina ...

Crisis Management

Crisis is a state of tension that puts the existence and goals of an organi ...

Strategic Leadership and Pandemic

Strategic Leader is the person who sets the roadmap to achieve the ultimate ...

Awareness, Appreciation, Success

It is very important for a person to recognize himself, discover his power ...

Woman and Career

People who are raised by unemployed mothers have a mother model in their mi ...

Conflict Management

In the broadest sense, conflict is disagreement between two or more people ...

Leading with Kindness

Kindness is an important virtue. Kindness in all areas of life makes relati ...

Smart Meetings

Meeting management is the process of managing all stages and components of ...

Negotiation Management

Negotiation is defined as a dialogue aimed at reaching a common and benefic ...

Virtual Leadership

The repercussions of the digitalization process in business life were sprea ...

Manager and Patience

Patience is an important concept in management. Patience is active, not pas ...

Being All Ears

Human beings differ from other creatures in their way of communicating. Com ...

Networking

The fact that managers in the corporate world act with awareness of network ...

Asking Strong Questions

For managers, asking a strong question is an important skill. Managers, who ...

Managing Yourself

The manager at work is in communication with the other parts of the busines ...

Mental Immunity

In the fight against Coronavirus (Covid-19) pandemic, knowledge and awarene ...