Bancassurance, a business model in which banks market insurance products to their own customer base, is becoming increasingly significant. This collaborative model offers additional revenue opportunities for banks while enabling insurance companies to reach a broader customer base. However, the key to sustainable success in bancassurance lies in effectively managing customer relationships and continuously training personnel in both the banking and insurance sectors.

In this article, we will explore how customer relationships can be managed in bancassurance, how to increase customer loyalty and satisfaction, the impact of digitalization on the industry, effective communication strategies, and the importance of staff training.

In the bancassurance model, customers interact with both banking products and insurance services. At this point, customer loyalty and satisfaction form the cornerstone of a successful bancassurance strategy. Since insurance products are often long-term and require regular renewal, effective management of customer relationships is crucial.

Customer Relationship Management (CRM) is a vital tool in bancassurance for understanding customer needs and offering the most suitable solutions. CRM software and technological solutions give banks and insurance companies a significant advantage by analyzing customer behavior, reviewing purchase history, and offering personalized services. Furthermore, addressing customer complaints quickly and effectively plays a critical role in enhancing customer satisfaction. Well-managed customer relationships increase customer loyalty and strengthen cross-selling opportunities.

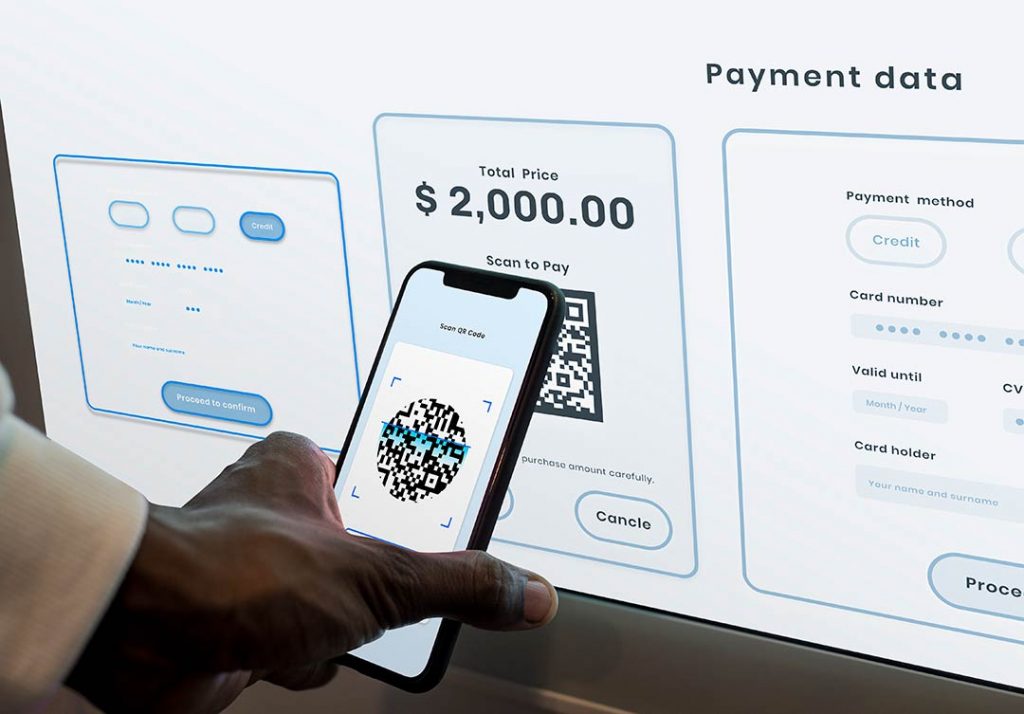

Digitalization is a transformative factor in managing customer relationships within bancassurance. Banks and insurance companies can offer faster, more accessible, and personalized services to customers through digital channels. Mobile banking, online insurance transactions, and digital assistants like chatbots have become effective tools for meeting customer expectations.

Another advantage of digitalization is the use of data analytics to provide better services to customers. Artificial intelligence and machine learning algorithms that analyze customer behavior enable banks and insurance companies to offer the most suitable insurance products. Additionally, digital channels provide a significant opportunity to collect customer feedback and increase customer satisfaction. Effectively managing digital channels is critical to improving customer relationships.

Effective communication strategies play a vital role in the success of the bancassurance model in enhancing customer satisfaction. Clearly communicating the benefits of insurance products, simplifying complex insurance terminology, and streamlining the insurance process are among the key factors in boosting customer satisfaction.

Given that insurance services often require long-term commitments, building trust with customers is essential. Bank personnel must be knowledgeable about insurance products and provide accurate, reliable information to customers, thus increasing trust in the bank. In this context, continuous training for personnel forms the foundation of an effective communication strategy that will enhance customer satisfaction.

Training for employees in both the banking and insurance sectors is a critical factor for success in the bancassurance model. Staff with in-depth knowledge of both banking and insurance products can offer better services to customers. Continuous education on insurance products and processes boosts both customer satisfaction and sales performance.

Optimizing training processes is crucial for improving the competencies of staff working in both banking and insurance. Particularly, leveraging digital channels and technological solutions makes training processes more efficient. E-learning platforms and remote education solutions support continuous development by enabling staff to receive training anytime and anywhere.

A customer-centric approach is also important in staff training. Training on customer relationship management, cross-selling techniques, and the marketing of insurance products helps employees better understand customer needs and offer appropriate solutions. Additionally, educating staff on new technologies and data analytics introduced by digitalization contributes to more effective customer relationship management.

Managing customer relations in bancassurance is critical for both banks and insurance companies. Successful Customer Relationship Management (CRM) is built on understanding customer needs, personalizing products and services, and providing continuous customer support. In this process, CRM acts as a bridge between the customer and the bank, key to increasing customer loyalty and satisfaction.

One of the most important steps in customer relationship management is customer segmentation. Banks can categorize their customers by age, income level, profession, and other demographic characteristics to determine the most suitable insurance products for each group. For instance, health or life insurance might be recommended to young professionals, while retirement plans could be more appropriate for older customers. In this way, banks can boost sales and ensure customer satisfaction by offering the right products to each customer segment.

With the advancement of digitalization, personalized communication strategies in customer relations have gained even more importance. CRM systems enable banks to analyze customers' past transactions, preferences, and needs, allowing for the presentation of personalized offers. Offering products that match the customer profile increases both satisfaction and loyalty. Personalized messages not only capture customer attention but also better respond to their needs.

In the bancassurance sector, digitalization is fundamentally transforming customer relationship management. Mobile banking applications and digital platforms make insurance products more accessible to customers, increasing their satisfaction. Digital tools can be used to instantly respond to customer requests, answer their questions, and even offer product recommendations.

Large banks, in particular, can instantly respond to insurance requests using chatbots and AI-powered customer service tools. These technologies not only improve the speed and quality of customer service but also reduce the operational costs for banks.

Digitalization also provides new opportunities to monitor and analyze customer behavior. Data analytics enables banks to understand which insurance products interest customers the most and which products are selling the best. These insights can be used to predict future customer demands and make strategic decisions.

It's important to understand that customer relationships in bancassurance extend beyond the sales process. Two-way communication with customers includes gathering their feedback and improving services based on this feedback. Customer feedback plays a critical role in the renewal of insurance products and increasing customer satisfaction.

Share:

Related Articles

The New Direction of Capital

In recent weeks, a notable trend has emerged in global markets: a visible p ...

Turkey’s Automotive Industry: On the ...

Turkey’s automotive industry has managed to preserve its production volume ...

Healthy Growth: Why Organizations Sl ...

Companies want to grow. More market share, higher revenues, larger organiza ...

Sustainable Leadership: Power Built ...

Today, the concept of sustainability sits at the center of almost every str ...

Why Do Managers Struggle with Genera ...

A reality long felt in the business world is this: there is a natural diffe ...

Leadership

Support, love, and trust received in childhood nurture self-confidence, cou ...

Generation Z: Not Just a Mirror, but ...

One of the most frequent complaints in today’s business world is: “Young em ...

A New Era in Business with Artificia ...

The Industrial Revolution began with steam. Then came electricity, computer ...

The New Face of Entrepreneurship: Wo ...

The new generation of entrepreneurship is no longer solely profit-driven; i ...

Understood Employees Contribute and ...

In the corporate world, we often hear statements like: “They’re talented, b ...

The Silent Power of Corporate Succes ...

In today's business world, organizations operate in an environment shaped b ...

Customer Relations and Training in B ...

Bancassurance, a business model in which banks market insurance products to ...

What Awaits the Business World? A St ...

Digitalization is no longer just a technological trend but a necessity for ...

Digital Transformation in Conflict M ...

Conflict is a reality we encounter in all aspects of life. Whether at home, ...

The Road to Success: Market Dynamics ...

In today’s rapidly changing market conditions, the importance of management ...

Leadership in the Digital Age: A New ...

Leadership in the digital age requires embracing continuous learning, innov ...

Mastering Risk Management

Mastering risk management is not merely an option for businesses but a nece ...

International Banking in Germany: A ...

Germany, with its strong industrial structure, high-technology products, an ...

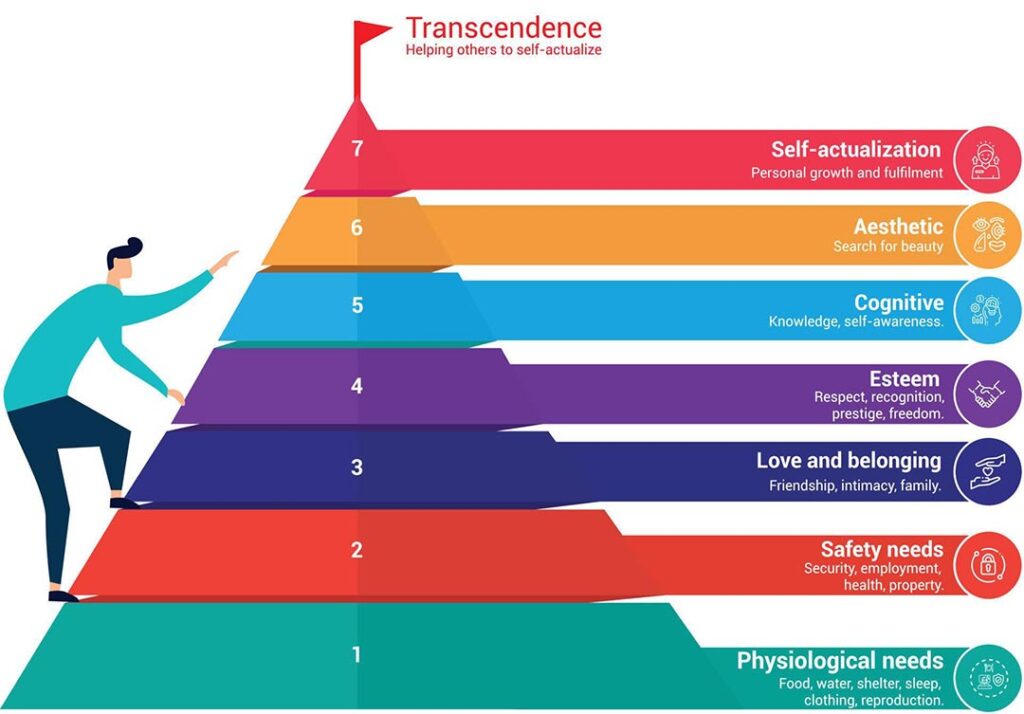

Leadership and Maslow's Hierarchy of ...

Abraham Maslow's hierarchy of needs is a fundamental psychological theory u ...

Leadership and Sustainability of Org ...

Today's business world is characterized by continuous change, technological ...

The Importance of Coaching Skills f ...

The Importance of Coaching Skills for LeadersCoaching skills are essenti ...

Fintech in Turkey: The Rise of Finan ...

Fintech in Turkey: The Rise of Financial Technology

Bancassurance

Bancassurance is a business model that is among the financial services offe ...

Banking and Frankfurt

When the banking and finance sector in Europe is analyzed, it is seen that ...

Digital Banking and Germany

Digital banking is a banking service where customers can do their banking o ...

Banking in Germany

Euro used since 2002 in The Eurozone, the currency of 19 EU members. There ...

Strategic Communication

Strategic communication plays a critical role in the success of an organiza ...

Importance of Supply Chain

The supply chain is a critical factor in which a company manages the flow o ...

Key to Success: Going Digital

Digital transformation is a transformation process that aims to increase th ...

Welfare

Poverty and inequality are one of the biggest challenges the current societ ...

ChatGPT

ChatGPT, developed by the OpenAI company known for its work and research in ...

What is Emotional Intelligence and w ...

Emotional intelligence (also known as emotional quotient or EQ) is the abil ...

The Importance of Women's Employment ...

Women's participation in the workforce is closely related to the level of d ...

Digital Banking II – Digital Banking ...

A serious step taken for the spread of “digital banking” in Turkey, providi ...

The Perception of Morality within Ma ...

If everybody in the world jumped out of a window, would you? This question ...

Digital Banking

Digital banking is a banking technology that offers customers the opportuni ...

Banking, Artificial Intelligence and ...

We have heard the concepts of metaverse, artificial intelligence and machin ...

Green Asset Ratio

Sustainable finance has an important place among the investments made for t ...

Servant Leadership

There is an effective form of management that we often hear about today: se ...

Sustainability In The Global Banking ...

Before Covid-19 wreaked havoc on the world’s economies, the global banking ...

Revolution of Digital Banking

With the European Central Bank considering to investigate for a digital cur ...

Taking Action and Making Decisions i ...

Uncertainty is the fact that an event is not within the framework of certai ...

Wind of Change

Change is an important concept that must be managed for employees at all le ...

Organizational Justice

“What is justice? Giving water to trees. What is injustice? To give water t ...

Open Banking

Digital transformation has started to show its effects in every aspect of o ...

Digital Literacy And Corporate Life

There are many innovations that managers and employees need to follow in or ...

Financial Literacy

The words money and economy are two important concepts that have a great pl ...

Sustainability and Bank

The solutions we have found to our various needs throughout history and ada ...

Adaptability, Flexibility and Leader ...

Being able to adapt to changing conditions is very, very important not only ...

Creativity and Leadership Relationsh ...

The world is getting more competitive every day. For this reason, the servi ...

Competitive Analysis and Banking Sec ...

Competition analysis requires you to examine your direct and indirect compe ...

Delegation in Management

The statements "two heads are better than one" or "teamwork makes the dream ...

Climate Change

All creatures evolve to best adapt to environmental impacts. Those who are ...

Change of Banking Service Channels i ...

Global crises such as the pandemic, force the existing structures to change ...

Innovation

It is undeniable that innovation has a very important place in today's worl ...

Artificial Intelligence

Artificial intelligence is no longer just something specific to science fic ...

Entrepreneurship

Entrepreneurship is the process of starting a new business that incorporate ...

Global Leadership

The world is changing day by day and the information we have today is out o ...

Resilience and Leadership

We encounter many events in life that cause us difficulties and stress. How ...

Entrepreneurial Spirit for Leaders

Why is important for success? The conventional perception of entrepreneursh ...

Finance Leadership in a Pandemic

Crises bring along a period in which institutions need to review their fina ...

Crisis Management

Crisis is a state of tension that puts the existence and goals of an organi ...

Strategic Leadership and Pandemic

Strategic Leader is the person who sets the roadmap to achieve the ultimate ...

Awareness, Appreciation, Success

It is very important for a person to recognize himself, discover his power ...

Woman and Career

People who are raised by unemployed mothers have a mother model in their mi ...

Conflict Management

In the broadest sense, conflict is disagreement between two or more people ...

Leading with Kindness

Kindness is an important virtue. Kindness in all areas of life makes relati ...

Smart Meetings

Meeting management is the process of managing all stages and components of ...

Negotiation Management

Negotiation is defined as a dialogue aimed at reaching a common and benefic ...

Virtual Leadership

The repercussions of the digitalization process in business life were sprea ...

Manager and Patience

Patience is an important concept in management. Patience is active, not pas ...

Being All Ears

Human beings differ from other creatures in their way of communicating. Com ...

Networking

The fact that managers in the corporate world act with awareness of network ...

Asking Strong Questions

For managers, asking a strong question is an important skill. Managers, who ...

Managing Yourself

The manager at work is in communication with the other parts of the busines ...

Mental Immunity

In the fight against Coronavirus (Covid-19) pandemic, knowledge and awarene ...